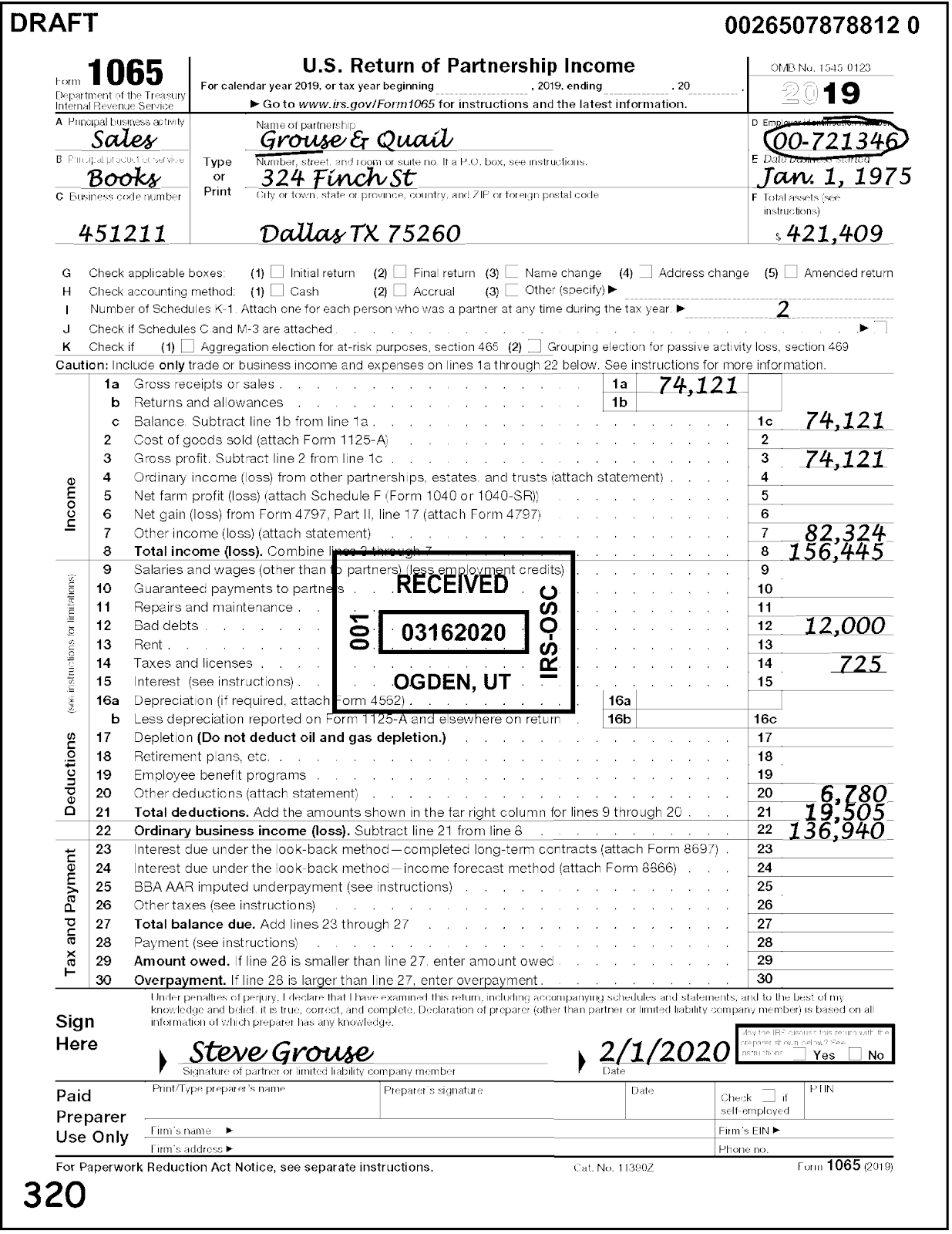

This penalty relief will be in addition to the reasonable cause exception to penalties for any incorrect reporting of a beginning capital account balance. The notice will provide that solely for tax year 2020 (for partnership returns due in 2021), the IRS will not assess a partnership a penalty for any errors in reporting its partners’ beginning capital account balances on Schedules K-1 if the partnership takes ordinary and prudent business care in following the form instructions to calculate and report the beginning capital account balances. To promote compliance with using the tax basis method described in the revised instructions, the Treasury Department and the IRS intend to issue a notice providing additional penalty relief for the transition in tax year 2020. Reporting using only one method assists the IRS in assessing compliance risk, and identifying potential noncompliance, while ensuring that compliant taxpayers’ returns are less likely to be examined. At the same time, the IRS did not receive practical alternative approaches to partner capital account reporting. The IRS and the Treasury Department received numerous comments from taxpayers requesting that the tax basis method approach be retained. In anticipation of requesting more consistent and useful tax information from partnerships, the Department of the Treasury and the IRS released Notice 2020-43 seeking public comment on other possible methods to report capital accounts to partners. Partnerships that did not prepare Schedules K-1 under the tax capital method for 2019 or otherwise maintain tax basis capital accounts in their books and records (for example, for purposes of reporting negative capital accounts) may determine each partner’s beginning tax basis capital account balance for 2020 using one of the following methods: the Modified Outside Basis Method, the Modified Previously Taxed Capital Method, or the Section 704(b) Method, as described in the instructions, including special rules for publicly traded partnerships. Under the tax basis method outlined in the instructions, partnerships report partner contributions, the partner’s share of partnership net income or loss, withdrawals and distributions, and other increases or decreases using tax basis principles as opposed to reporting using other methods such as GAAP.Īccording to IRS data, most partnerships already use the tax basis method although partnerships previously could report capital accounts determined under multiple methods. The revised instructions indicate that partnerships filing Form 1065 for tax year 2020 are to calculate partner capital accounts using the transactional approach for the tax basis method. The revised instructions are part of a larger effort by the agency to improve the quality of the information reported by partnerships to the IRS and furnished to partners to facilitate increased compliance. Return of Partnership Income, for tax year 2020 (filing season 2021) that include revised instructions for partnerships required to report capital accounts to partners on Schedule K-1 (Form 1065). WASHINGTON – The IRS released today an early draft of the instructions to Form 1065, U.S. IRS releases draft Form 1065 instructions on partner tax basis capital reporting Note: If the due date falls on a weekend or holiday, the due date is the next business day.Issue Number: IR-2020-240 Inside This Issue

Remaining installments will then be due on the 15th day of the 6th, 9th and 13th months of the fiscal year. Example: If your fiscal year begins on April 1, your first payment will be due on July 15.

The first payment for a fiscal year filer must be filed on or before the 15th day of the 4th month of the fiscal year.

The estimated tax is payable in equal installments on or before April 15, June 15, September 15, and January 15. The first payment for a calendar year filer must be filed on or before April 15 of that year. Calendar Filers: Due on the 15th day of the 4th month after the tax year ends.įiscal Filers: Due on the 15th day of the 4th month after the tax year ends.

0 kommentar(er)

0 kommentar(er)